sales tax in san antonio texas calculator

The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in San.

4 Ways To Calculate Sales Tax Wikihow

The portion of the sales tax rate collected by San Antonio is 125.

. Tax info is updated from. The minimum combined 2022 sales tax rate for San Antonio Texas is. The results are rounded to two decimals.

The 78216 San Antonio Texas general sales tax rate is 825. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax. The December 2020 total local sales tax rate was also 8250.

There is base sales tax by Texas. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. Sales Tax calculator San Antonio Fill in price either with or without sales tax.

Martinez California and San Antonio Texas. Sales tax in San Antonio Texas is currently 825. Texas Sales Tax.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Sales Tax calculator San AntonioMedina Co. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in San.

625 sales tax in Llano County You can use our Texas sales tax calculator to determine the applicable sales tax for any location in Texas by entering the zip code in which the purchase. Use our free sales tax calculator to look up the sales tax rates for any US address. This is the total of state county and city sales tax rates.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees. Higher sales tax than any other Texas locality San Antonio collects the maximum legal local sales tax The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125.

Counties cities and districts impose their own local taxes. Fill in price either with or without sales tax. While many other states allow counties and other localities to collect a local option sales tax Texas.

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. S Texas State Sales Tax Rate 625 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the. What is the sales tax rate in San Antonio Texas.

Texas residents 625 percent of sales price less credit for. All fields except Zip Code are optional. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San.

Do You Pay Sales Tax On A Mobile Home Purchase Mhvillager Blog

Does Texas Have Trade In Tax Benefits On Used Vehicles

How Much Is The Property Tax In Round Rock Texas Quora

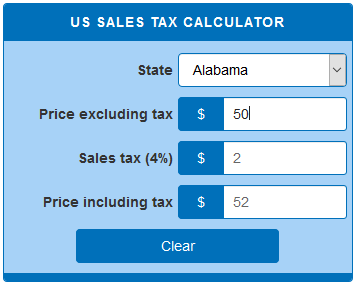

Us Sales Tax Calculator Calculatorsworld Com

California Sales Tax Rate Rates Calculator Avalara

Texas Sales Tax In 2017 What You Need To Know The Motley Fool

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Study Despite Having No Income Tax Texas Has 11th Highest Tax Rate In The Country San Antonio News San Antonio San Antonio Current

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Everything You Need To Know About Filing Taxes In Multiple States Forbes Advisor

U S Cities With The Highest Property Taxes

Tax Implications When Selling Your Texas Rental Property Cyber Homes

Texas Used Car Sales Tax And Fees

Equivalent Salary Calculator By City Neil Kakkar

Not All Property Tax Deductions Are Limited Texas Realtors

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price